Environmental economics

Introduction to environmental economics

Peculiar features of the use of natural resources

In case of private assets consumers compete for goods and it is possible to rule out a part of the consumers. Essentially, private assets are the traditional market goods which can be gained at the market for money and their consumer can be determined exactly. In case of pure common assets however, nobody can be ruled out from the use of these valuables and there is no competition between consumers since the consumption by individuals does not decrease the stock available for others. Furthermore, common goods can be characterized by collective consumption, which means that numerous persons can consume the same service simultaneously, it is available to everyone and nobody can be ruled out from their benefits. Many kinds of environmental resources can be classified in the category of common goods. Generally, two groups are mentioned in the literature:

- free natural goods

- and produced common goods.

Free natural goods, like water, air, landscape, biodiversity etc., are available without limitation for everyone, while produced common goods are the results of a production process. Those goods and valuables in case of which individual consumption does not decrease their quantity, but some consumers can be ruled out from their use are called mixed goods. Negative effects of the use of common goods could manifest as public detriments, such as greenhouse effect, decreasing species diversity and acid rains. An outstanding example for the various environmental problems is the so-called tragedy of common pastures. The concept can be linked to the article titled „The Tragedy of the Commons” published in 1968 in Science by a biologist named Garrett Hardin.

Garrett Hardin (1915 – 2003)

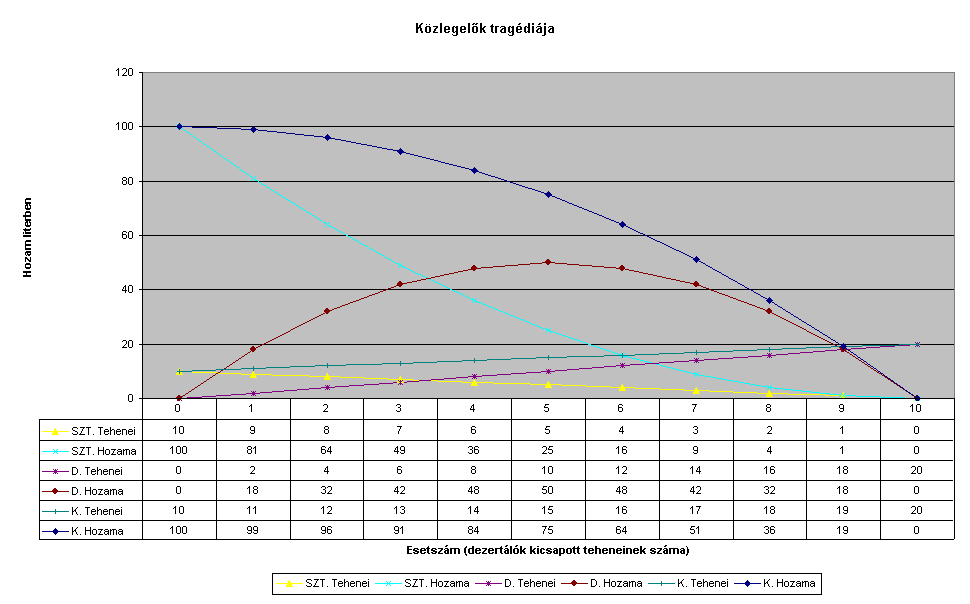

In this famous article, Hardin mentions an English common pasture as an example. The main characteristic of this pasture is that it is able to feed 10 cows of which each of them can produce 10 litres of milk per day. After some time, one of the farmers brings another cow to the pasture. What is the consequence of this? Less grass will be available for the cows; therefore they are going to produce only 9 litres of milk per day. However, the farmer who has 2 cows on the pasture gains 18 litres of milk per day and his income is going to grow proportionately. This is noticed by another farmer and he will also bring another cow to the common pasture. The daily milk production of all the cows decreases to 8 litres, but two of the farmers gain 16 litres of milk per day. And the process goes on, every farmer will bring another cow to the pasture.

The Tragedy of the Commons

When 6 farmers brought an extra cow to the pasture, even the farmers with 2 cows begin to gain less milk than the original 10 litres. If 8 farmers have 2 cows each on the common pasture, they gain only 4 litres of milk. And the ninth farmer would not even gain anything by bringing a second cow to the pasture. The common pasture functions optimally only until the point where each and every user respects the rules set by common agreement. However, deserting provides more benefits in any given point of time for a farmer, while the situation of the other farmers only slightly deteriorates. Altogether, when individuals make decisions fit for their own interests concerning the use of given resource, eventually they are going to cause harm for themselves. (Legend to the abbreviations of the table above: SZT=Rule keepers, D=deserters, K=community.)

A practical example of the tragedy of the commons is the pollution of the environment. The tragedy of the commons supports the fact that by applying this approach, stocks finally peter out and common goods will perish

Interpretation of the concepts of environmental and resource economics and ecological economics

The discipline of ecological economics is positioned on the boundary of economics and ecological sciences. The primary objective of this discipline is to establish models that handle and studies socio-economic-natural system as coherent systems embedded into each other and developing together. The central question of the research works is to determine the boundary conditions of a sustainable economic system and working out the appropriate model.

Ecological economics starts from the system of nature and through the logic of nature, tries to give answers to conflicts and contradictory problems between the economic and social sphere. If the mutual relationships between economy and nature will be successfully explored, answers are going to be given along these relationships to make the operation of the socio-economic system accord with the functioning of the biosphere. (Significant researchers of the field are e.g: Schumacher E., Boulding K.E., Costanza R. etc.)

Representatives of environmental and resource management think that advance towards the solution can only be achieved if phenomena are studied from the aspect of the market. This field analyses how market conditions can be transformed in a way that the socio-economic sphere should become sensitive to the natural-environmental problems. Pollutions and the mitigation of their effects stand in the focus of the studies of environmental economics.

Representatives of environmental economics see the key to the solution in market tools, while representatives of ecological economics are debating among each other on the assessment of the role of the market. (For example Schumacher is on the opinion that if we allocate prices for natural valuables, then it is just like selling out nature. On the contrary, Boulder has come to a conclusion that the principal problem is that there is no realistic price given for natural resources.) Both disciplines agree that they consider nature as the basis of all kinds of economic activities.

The concept and characteristics of externalities

A well-renowned representative of neoclassical economics, Alfred Marshall introduced the concepts of costs and benefits into economics. He used these concepts for such kinds of events when e.g. a company affects the operation of another business unit even without having a market relationship. Since the presence of this kind of effects disturbs the functioning of the market, neoclassical economists thought it very important to include these in economic calculations.

Alfred Marshall (1824 – 1924)

The concept of external economic effects, or externalities can be linked to the work of Arthur Cecil Pigou, an English economist, published in 1920 titled Economics of Welfare. In his work, Pigou distinguished social and private costs and founded his theory of external economy.

In the course of an economic activity, the process is very simple: a trade-off is realized between a producer and a consumer who are in relationship with each other via the market. But if this contract results in unexpected and unintended costs or benefits for a third party, then externalities can be observed. This means that the third party is not part of the market, did not make any contract with the producer of the consumer, however, still becomes affected by the economic activity realized. So, if the third party must endure an out-of-market effect, it is an externality.

Well-known economists have been dealing with this topic: authors Samuelson and Nordhaus (1998) made the following definition: „‘Externalities or “spillover effects” occur when firms or people impose costs or benefits on others outside the marketplace”. ‘An externality exists when the production or consumption of a good directly affects businesses or consumers not involved in buying and selling it and when those spillover effects are not fully reflected in market prices.

Paul Anthony Samuelson (1915 – 2009)

William Dawbney Nordhaus (1941 – )

Grouping of externalities can be done in multiple ways. Positive and negative, producer and consumer externalities can be distinguished. In case of positive externalities, the economic player affected by an external effect gains a benefit from the externality. Therefore the economic activity of this player results in greater benefits or can be conducted with smaller costs. In case of companies, the profit maximizing output is smaller than the amount favoured by the society. In case of a negative externality, the externality has a detrimental effect on the environment of the affected person or entity. In this case these external effects result in the increment of the costs needed for the same amount of production or decrease the consumer benefit.

Negative externalities can be of technological or financial character, and can be related to common goods or private properties. There are cases when both positive and negative externalities emerge simultaneously. Additionally, reversible and irreversible externalities can also be distinguished. In case of reversible externalities, the resources are available for all participants and the cost can be transferred to each other. In case of irreversible externalities, the benefit or cost of the user of the resource is directed only in one direction.

Consumer externalities arise when consumer behaviour causes some unintended side effect which can be either positive or negative. Producer externality emerges when the behaviour of the producer of manufacturer causes the externality which also can be positive or negative.

Altogether, it can be stated that costs of externalities emerging in the form of pollution of the environment are increasing, affect larger and larger proportion of mankind and detrimentally affect the quality of free common goods. A distinct peculiarity of free common goods is that they can seem to be worthless for the economic players in the course of their economic decision making process, and are handled as they could be used in unlimited amounts.

Environmental pollution is not wilfully caused by the polluting company or person, however, if that entity wants to increase the profits by greater production, generally disregards this factor in the course of the decision making process, since it does not emerge as a direct expenditure. External impacts, their associated costs and benefits are neither considered by the seller and nor the buyer, and will not be included in the market price.

Economic consequences and economically optimal level of external effects

As we have mentioned it before, growth of production and consumption can have such economic impacts that cannot be handled by traditional market mechanisms. These outer (external) impacts lead to the so-called market failures. The reasons for this in relation with the environment are given by Szlávik (2007) as follows:

- lack of available information, data on environmental impacts associated with the use of resources,

- expected future impacts of current activities are not considered thoroughly enough by those using the resources of the environment,

- property rights are unclear in many cases,

- inappropriate price structure that determines the market opportunities associated with the resources,

- differences in cultural, legal etc. rules regarding the behaviour of individuals.

An important feature of externalities is that they do not appear directly in the market or via the prices. From the aspect of environmental ecology, it is clear that the external impact affecting the welfare of people is at least as important as the effect of market products or services with a given price. Situation considered generally as optimal solutions or equilibriums are not what they meant to be, while the prices of external impacts are not included or become miscalculated in the model.

It is well known from the literature of environmental economics that external effects appear more significantly and the number of affected entities grows continuously. While individual economic players strive to increase their profits and serve public benefits, it can also happen that as a consequence of negative externalities they do not provide benefits, but damages for the public. Traditional economic methods are not considering external damages in profitability measurements, and do not deduct the damages caused to third parties from the profit of the company.

In this respect, the environment is totally worthless in the eye of the economic player, because it is available for free. And given the traditional methods, the economic entity does not even notice in the course of its operation that it causes damages to third parties due to the side effects of its activities.

In this chapter, we analyse the optimal level and impact of externalities. Of course, analysis of this issue strictly from ecological, environment protection aspect is not appropriate, since the most optimal solution for the society would be if the negative externalities would not even exist. In practice, by considering also aspects of sustainability, the issue can be interpreted in many cases as it is shown in the next figure.

Economically optimal level of externalities

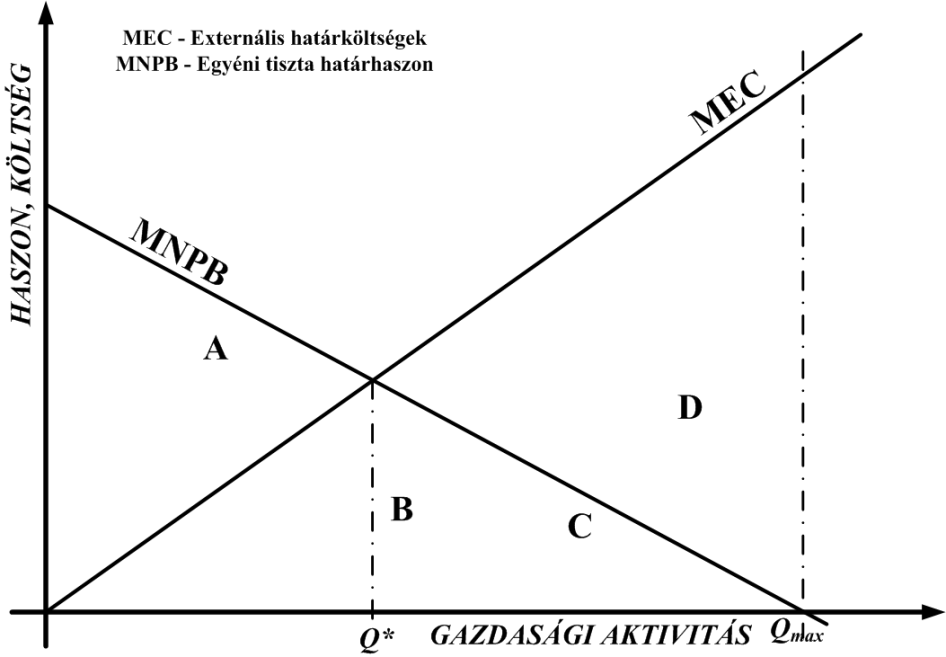

If free competition is supposed, the demand function is parallel to the x axis, since the change in the supply of individual producers does not have a modifying effect on the price. If we deduct the marginal costs of the individual producer from the price, we obtain the marginal benefit of the polluting activity of a competing producer; this is indicated by the MNPB (Marginal Net Private Benefit) curve.

MNPB curve shows the amount of extra benefit for the producer coming from extending the polluting activity with a single unit (Szlávik (2007), Kerekes (2007)). This benefit is the largest when the amount of production is Qm. The area below MNPB is identical to the profit of the producer, this is the net benefit. The MEC (Marginal External Cost) curve shows the external marginal cost arisen by the society as a consequence of the polluting activity. Q∗ is the intersection point marking the level of activity where the marginal benefits of the producer are equal to the marginal damages of the society. This means that at an economic activity less that Q∗ the benefits of the producer are greater than the damages of the society.

Areas under the curves have the following meaning according to Szlávik (2007) and Kerekes (2007):

B: the economically optimal level of the externality,

A+B: the social optimum of the net private benefit,

A: maximum of social net benefit,

C+D: the part of the externality that must be avoided,

C: the part of the net private benefit that is not recognized by the society,

Q*: the socially optimal level of the economic activity,

Qm: level of the economic activity providing maximum private benefit.

According to the literature, the figure above shows that environmental protection is not without costs and producers can be forced only by applying an external tool to decrease their economic activity from the Qm level providing maximum profits to the Q* level that can be recognized by the society. Such external tools are the taxes and norms described in the chapter below.

Management of externalities in different economic theories

An English economist, Arthur Cecil Pigou, emphasized the importance of internalization of externalities. One of the economic approaches of managing externalities is associated with Pigou. According to his theory, taxation is the most appropriate way to make external economic effects to be considered in the decisions of economic players.

Arthur Cecil Pigou (1877 – 1959)

The main objective of Pigou was to make natural environment and human environment as important during economic decision making as labour and capital. To reach this goal, he studied the effects of the introduction of a special tax.

According to Pigou, if the amount of tax is t* that has to be paid after the activity of the polluting entity, this will force economic entities, companies to reduce their activities from the level of Qm to Q* which is the socially recognized, optimal level of production.

The figure above also indicates the marginal benefit reduced by this amount of tax. This is zero at Q* production quantity and becomes negative after this point which means that additional economic activity is not recognized by the society due to the pollution associated with it.

As it can be seen in the figure, the optimal amount of the tax is identical to the external marginal cost of the optimal pollution level. This means that for determining the amount of the tax, the following factors must be known:

- place and characteristics of the curve of external marginal costs,

- and the place and characteristics of the curve of private net marginal benefits.

In practice, these two conditions are very hard to be met. Economic players know their own marginal benefits and their changes but the authorities do not have information. Moreover, these individual producers do not know about the damages their activity causes to society. Literature mentions this phenomenon as „information asymmetry”, what prevents the introduction of this tax in practice.

The theory of Pigou is only one of the economic ways to manage externalities. Ronald Coase, a Nobel-laureate American economist thinks that there is no need to state intervention in order to manage external economic impacts: the market will find the socially optimal level by itself, in case the proprietary rights are fixed and clear.

Ronald H. Coase (1910 – )

According to the study of Coase published in 1960, efficient distribution can be achieved if:

- bargaining costs are negligible,

- affected parties are free to engage into negotiations,

- the number of affected parties is small,

- jury can give authorisation to any of the parties.

Coase’s theorem says that no matter who owns the property rights, the system will reach its optimum by the way of bargaining (Kerekes, 2007). The consequence of the decision made by the court is that it can modify the distribution of costs and benefits among the affected parties.

Polluters and victims of environmental pollution will bargain supposedly on the basis of the marginal cost of their damage and the benefits, and the costs of mitigation about the optimal level of the economic activity resulting in the pollution.

The operation of the mechanism supposed by Coase is as follows: in case of lack of regulation or lack of balancing effect of endangered players, the polluter tries to operate at a level where he can maximize his profits. The social optimum however, is at the point where the marginal benefit arising from the activity of the polluter equals the social marginal loss due to the pollution. If the victim has a legal right to a non-polluted environment, then the polluter must pay compensation. This means that theoretically such a natural tendency is going to be established that progresses towards the social optimum. According to the presumption of Coase this theorem is true even if the polluter has his own rights and the victim must pay in order to decrease or quit the polluter’s activity. The Coase-theorem says that no matter who has legal rights, an automatic tendency is going to be established towards the achievement of social optimum via bargaining and negotiations.

References

Bartus Gábor (2008): Van-e a gazdasági tevékenységeknek termodinamikai korlátja? Közgazdasági Szemle, LV. évf., 2008. november (1010–1022. o.)Környezet- és természetvédelmi Lexikon (Szerk.: Láng I.) Akadémiai Kiadó, Budapest, 2002.

Kerekes S. (2007): A környezetgazdaságtan alapjai. Aula Kiadó, Budapest.

Millenniumi Ökoszisztéma Értékelés – Millennium Ecosystem Assessment (2005): Ecosystems and Human Well-being - Biodiversity Synthesis. Millenium Ecosystem Assessment, Island Press, Washington, D.C.

Mishan, E.J. (1982): Költség-haszon elemzés. KJK, Budapest

Moser M. – Pálmai Gy. (2006): A környezetvédelem alapjai. Nemzeti Tankönyvkiadó Zrt, Budapest.

Samuelson, P.A. – Nordhaus, W.D. (1987): Közgazdaságtan. KJK, Budapest.

Szlávik J. (szerk.) (2007): Környezetgazdaságtan. BME GTK Közgazdaságtudományok Intézet. Typotex Kiadó, Budapest.